One of the most spectacular features of a digital trade aka cryptocurrencies is their volatility. Leading to this, the price of digital gold that is the crypto coins involved changes in an instant in time. A coin that values millions during the daytime can change its value millions of times and there is no limit upto which its value can variate. The value can attain new peaks or can fall to the bottom. As a result, a proper study of the market is a necessity and should be done before going ahead with any type of deal, especially in transactions involving a huge volume of funds. If you are planning to invest in Crypto, you can learn more by visiting bitcoinfuture.app.

In the digital market, various indicators can help one to predict current and future market trends. An ascending triangle is one of the indicators that can help a user to go through the market trends and allow him to go through a successful trade. In this article, we are going to discuss the methods through which one can easily trade using this feature of an ascending triangle pattern.

About ascending triangle pattern

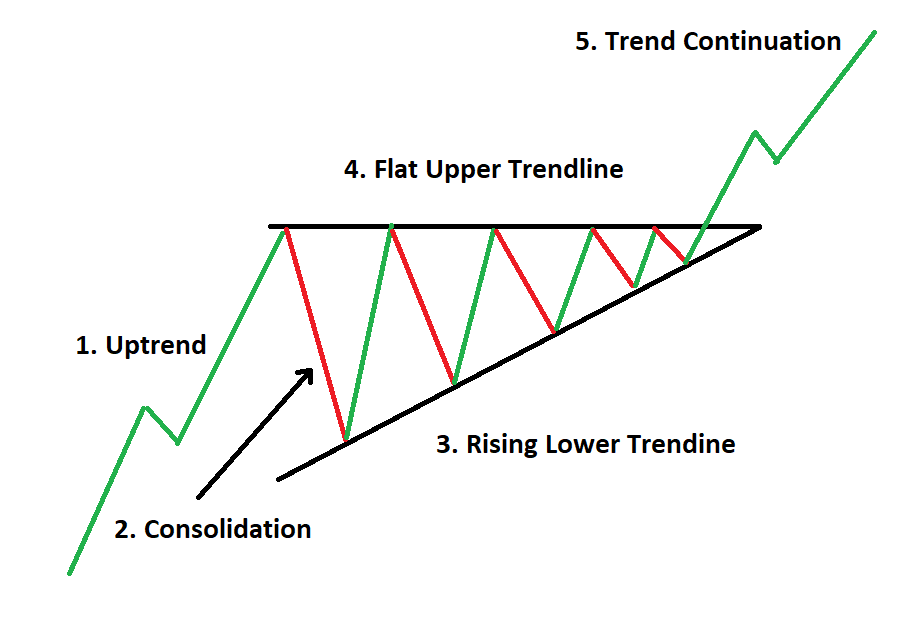

The result of a rising trendline support and a horizontal trendline resistance is none other than a famous form of trading pattern that is an ascending triangle pattern. The pattern is usually generated during the time of a serious trend going to be up and similarly in the down direction. According to analysts, it can be identified from a continuous pattern, which means the general market trend resumes. It should be kept in mind, the ascending pattern in these patterns is not always indicative of the bullish market season but can be depicted to be various in their meanings. In some instances, the ascending triangles mean the end of a unique market!

How to use a triangle pattern?

The ascending triangle can help a user to track the current as well as the future trend effectively. This feature can help the customers to analyze and measure the targets related to their profits demand and the upcoming breakout or some kind of breakdown. The bullish trend can be measured by considering the distance between the upper and the lowest point in a trendline. The distances between upper and lower points help the user to calculate the ultimate profits and at the same time the user can successfully work on the losses incurred by calculating the distances from the same observation.

To be cautious of the fakeouts

Whenever an up stick is seen, it is a measure of strength and power of design. Similarly, when a comparative flat stick is observed, the breakout can be assumed or not having enough momentum is obtained. To reduce risk, one can also use a stop-loss trend. The traders can also work on the scenario of breaking out or breaking through.

Benefits of using a triangle pattern

Using a triangle pattern can be advantageous in many ways and some of the advantages of using these patterns can be defined as under.

- The method of triangles is an easy approach to speculating the down as well as the uptrends.

- The falling values can easily be tracked and similarly, the values falling by some values can easily be tracked down.

- There are visual chores that can be used for ascertaining the choice of actions depending on the situation of the current as well as the future market trends.

- It is referred to as the most simple of all types as various combinations of candlesticks and others can be found combined in the structures formed in the marketplace trends.