There are now various apps for more insight into your personal spending pattern. ABN-AMRO is also doing its bit in this area with the Grip app.

By: Dennis Gandasoebrata

The Grip app has been around for several years and has been functionally expanded over time. You can use the app as a customer of ABN-AMRO, but also if you are a customer of ASN, ING, Rabobank, Regiobank, SNS Bank, Triodos Bank, Knab and Bunq.

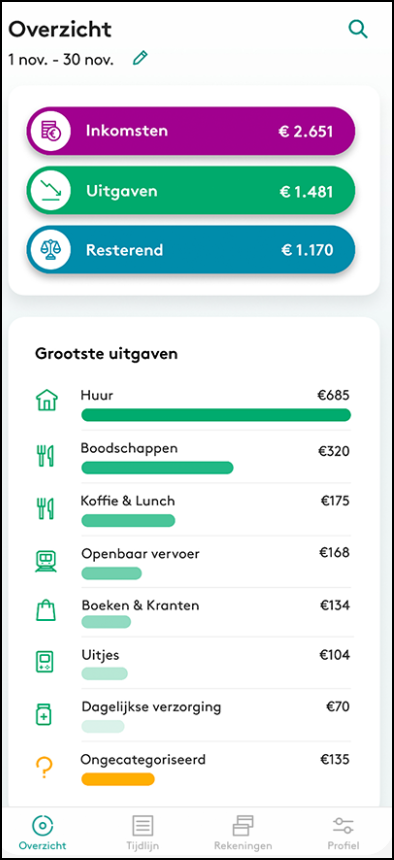

The app lists all (recurring) expenses and makes it clear where the money flows. You can also see what costs you incur for subscriptions and you have the option to cancel subscriptions that you no longer use via the app.

To keep spending more under control, you can create budgets yourself. For each budget, we keep track of how much money is left or whether you have a deficit. To prevent the latter, you can set up a push notification that notifies you when the budget is almost exhausted.

Also useful is the total overview, in which you can see the balances of all supported banks, including credit card statements. You can also export the overviews to a comma-separated file (CSV), for further use in an accounting program, for example.

Product: gripabnamro.nl/nl/private/internet-enmobiel/apps/grip/index.html

![]()

Price: free

System requirements: Android 7.0+, iOS 11.0+

Language: Dutch, English