In 2024, Dutch consumers lost almost a billion euros on hidden interchangeable costs. This is partly caused by a lack of knowledge among Dutch people about international payments and the confusing, complicated language of banks and financial service providers. Also read the tips for smarter international payments.

A recent study commissioned by International Payment Company Wise shows that the Dutch have paid 973.43 million euros in hidden costs for international payments. The amount is expected to increase further by nearly seventy million euros in 2025. The findings, originating from independent research by Edgar, Dunn & Company (EDC) and research by Institute Ivox among 2,000 respondents, emphasize the need for more transparency in the costs of international payments and better awareness about hidden costs among the consumers.

Hide extra costs

The Dutch travel a lot, often do business and investments or study abroad. Implementing international payments is therefore very common among Dutch people: 51 percent do that at least once a year and 17 percent even monthly. In 2024 alone, the total value of foreign transactions by Dutch consumers amounted to 48.5 billion euros.

Yet 55 percent have little or no insight into the way in which international payments work or what they actually cost, such as with debit cards, money recordings in foreign currency and transfers. Banks and other providers often charge transaction costs in advance, but hide extra costs in, for example, an unfavorable exchange rate – without communicating transparently to their customers.

Half of the Dutch are aware that banks will charge more than the standard exchange rate. But 31 percent of those who make international payments at least once a month do not fully understand the size of these hidden costs. This underlines the need for more transparency and clear communication from financial service providers.

Additional costs

With payments abroad, additional costs are often charged, without clearly informing consumers. In the Netherlands, traditional banks and other payment providers usually add a margin of 2.9% (source: EDC) to international transactions. These hidden costs are often processed by offering higher exchange rate margins. In addition, the course offered is less favorable than the actual, average exchange rate and the consumer ultimately pays more.

Another common way to hide costs are dynamic currency change costs (DCC). They occur when a retailer or supplier gives the option to settle the transaction in euros, rather than in the local currency. People often think that they pay less exchange rate costs, but usually that is the opposite because a poorer exchange rate is chosen. Finally, money recordings abroad can also lead to extra costs, with additional costs of both the home bench and the foreign ATM provider.

Need for more transparency in the financial sector

For consumers who want to gain clear insight into the costs for which they pay for international transactions, the complex use of banks of banks remains a big barrier. Only three in ten Dutch people think that banks understandably communicate about their international costs. The other nearly seventy percent indicates that banks are little or not clear about this in their language. This has consequences for practice: 42 percent of those who make at least one international payment per year is surprised by unexpected transaction costs.

“The Dutch often lead an international life – whether they are traveling, studying or doing business abroad. Nevertheless, banks and payment providers benefit in an unfair way of hidden costs and unclear price structures, at the expense of their consumers. They must know exactly what they pay in order to be able to make well -considered financial decisions. The solution is now in which they have been in full expectations of the new European rules. Transparency at banks and payment providers, so that ultimately more money ends up where it belongs: with Dutch consumers, “says Magali van Bulck, head of EMEA policy at Wise.

More transparency also creates opportunities for innovative alternatives: 59 percent of the Dutch are considering switching to a provider with lower, more transparent costs and one in six already used options such as multi-speed cards of new (fintech) players.

Tips for smarter international payments

To avoid unnecessary costs when spending or sending money in other currencies, Van Bulck recommends the following steps:

• Check all your bank costs: check both the transaction costs and the exchange rates before you make an international transfer. The difference in exchange rates can have a major influence on the amount that you actually pay. The closer the transaction costs are at the price that you find via Google or Reuters, the better.

• Comparing is to win: paying with your payment card is not always the best option abroad. Therefore, compare different payment methods to find the most transparent and affordable option.

• Pay in local currencies: When you are abroad, choose to pay as much as possible in the local currency to avoid dynamic interchangeable costs (DCC), which banks and other providers use to charge your costs.

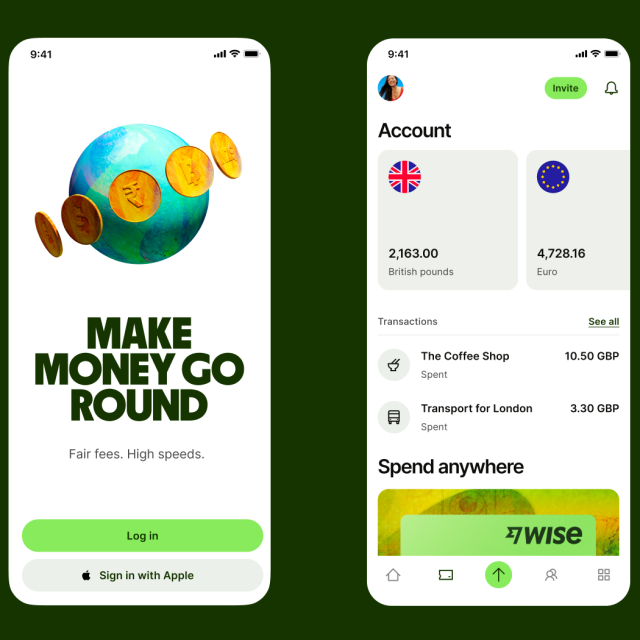

• Use cost-effective and transparent tools: consider a multi-speed card, such as that of Wise, with which you can save, spend and exchange money at the average exchange rate. Because of this you do not pay hidden costs and you get full transparency.

Transparency, speed and flexibility for Dutch customers

With Wise Account, people and companies can keep more than forty currencies and exchange against the middle price – the same course that can be found via Google and without hidden costs. They can also make returns on their money in Euro, Dollar and British pound through the product assets. The middle rate: the average market change rate is the middle between the purchasing and sales rates on the currency markets in the world.

Research Ivox

Online survey by research agency Ivox from 21 to 26 February 2025 among 2,000 Dutch people who are representative of language, gender, age and degree.

The data on hidden costs for 2025 from Edgar, Dunn and Company were calculated on the basis of the exchange rate margin that the largest banks in the Netherlands offer when their customers move money from the country. The data is in Euro (converted on the basis of the average exchange rate for USD/EUR for 2024), expressed in millions and projected on the basis of the expected GDP growth in the Netherlands.