AfterPay is a payment service that allows customers to pay after receiving the product. How does it work and what are the main points of attention?

AfterPay is a payment service that allows customers to pay after receiving the product. How does it work and what are the main points of attention?

What is AfterPay?

Many webshops now accept AfterPay as a payment method. Customers only have to pay for an order afterwards. They can first investigate whether the purchase is satisfactory. If you return the product, you pay nothing. AfterPay is an intermediary. Consumers pay the outstanding invoice to AfterPay, after which the payment service pays the amount to the webshop.

Stores with Afterpay

Not all web stores accept AfterPay as a payment method. Coolblue, Amazon.nl and Bol.com, for example, do not support it. All kinds of other well-known online sales addresses are affiliated with AfterPay. Think of Fonq, Decathlon, Intertoys, Blokker, Xenos, Praxis, Pets Place and Lucardi. Furthermore, a striking number of clothing stores support this payment service, including The Sting, Scapino, WE, Shoeby and Zeeman.

How does Afterpay work?

Checking out with AfterPay is simple. Add the intended products to the shopping cart and select AfterPay as the payment method during the ordering process. Consumers fill in their personal details and complete the order. Some online stores do charge extra costs for AfterPay. For example, Intertoys adds an amount of 1.85 euros to the invoice.

AfterPay must always approve the order first. People who are in debt restructuring or under administration usually cannot pay afterwards. And if you pay via AfterPay for the first time, you cannot pay high amounts yet. AfterPay approves more than ninety percent of all applications.

Invoice by email

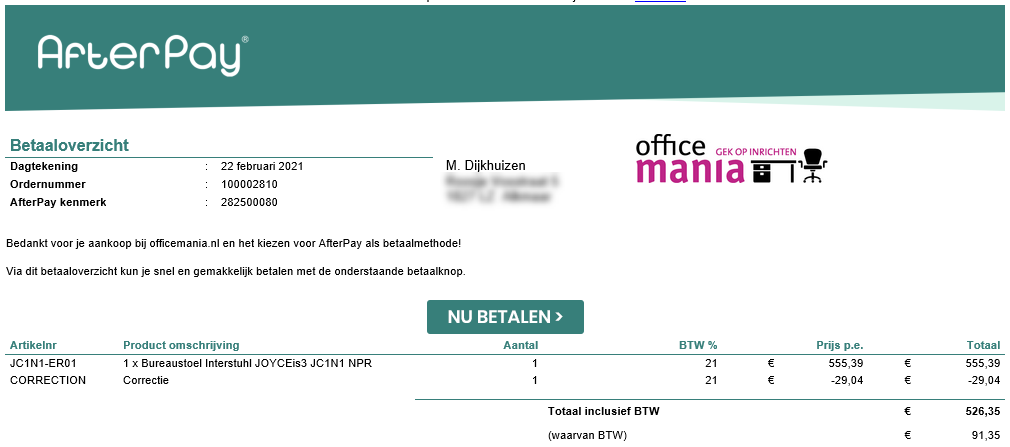

If the ordered products have been delivered to the home address, the customer will receive an AfterPay invoice after a few days. This is done by email. Consumers have fourteen days to transfer the requested amount. An advantage is that returns are usually already processed by the webshop. People therefore only pay for goods that they definitively buy.

Payment of an AfterPay invoice can be done via an iDEAL transaction or manual bank transfer. In the latter case, the customer must provide an AfterPay reference. The invoice states exactly how the payment works.

AfterPay app

Fakemails AfterPay

Most people are familiar with those misleading fake emails from banks by now. Fraudsters also misuse the AfterPay name for their fake emails and text messages. Such a message states, for example, that someone has ordered a product via your AfterPay account. You could then cancel this order via a link. Do not fall for that and never click on such a link. Don’t trust an email or text message? Please contact AfterPay customer service.