Customers of major Dutch banks can pay contactless with their iPhone and Apple Pay. But how does it work and is it safe?

Ernst Roelofs

Since a few months, customers of SNS, ASN and Regiobank have also been able to make contactless payments with Apple Pay and they no longer need their bank’s debit card. Previously, Apple Pay was already possible for customers aged 16 and older at ING, Rabobank, ABN AMRO, bunq and Knab, among others. iPhone owners can use Apple Pay for free. You can also pay online and in apps easily and securely on an iPhone, iPad or Mac. In this article, we’ll tell you what Apple Pay is and how you can use it.

If you don’t have an iPhone, some banks also allow you to use Google Wallet (formerly Google Pay), Garmin Pay, or a ring or other item you carry with you (wearable).

|

| On the Apple Watch, the Apple Pay payment with two side button presses |

So easy

To use Apple Pay, you need the Wallet app in addition to your own bank’s app.

At first I could only ‘scan’ the credit card via ING; the other cards had to be added via the ING app. Adding bank cards is quite intuitive and almost every bank has an instructional video about this.

To start a payment with Apple Pay, first press the side button twice on iPhones with Face ID and the Apple Watch. Then, to unblock your iPhone, scan your face. With the Apple Watch you are already identified if you have entered the correct code when putting it on and you can pay immediately by holding your device against the payment terminal for a few seconds. With an iPhone with a home button, you first hold the top of your iPhone close to the payment terminal, as you are used to with contactless payment cards. If your payment card doesn’t appear automatically, double-click the Home button to choose an account and hold your finger on the Home button until you hear a tone and feel a vibration.

If you want to pay with a different card once, you can tap the image of a card to pay with a different card before confirming your payment.

|

|

The Apple Watch is even more convenient to pay with Apple Pay |

Per device

After successfully activating Apple Pay on my iPhone, the payment cards were visible in the MacBook Wallet, but you have to register them with your bank for each Apple device. Unfortunately, this was not accepted several times for me, so a screenshot of an online Apple Pay payment is missing.

With the iPad you can – due to the lack of NFC – only pay in apps and online in Safari. It is then an alternative to iDEAL, for example. Furthermore, with slightly older Macs without Touch ID, you also need an iPhone or Apple Watch for online payments with Apple Pay.

Safety

Every device that supports Apple Pay has one Secure element. After checking the entered card and account number, an encrypted device account number from your bank is stored in this extra secure chip. This token is unique per device and bank card, and not available within iCloud. When using a new device, you must add your bank cards to Apple Pay again for maximum security. To prevent misuse, Apple also checks whether your device is in normal use.

Because you always have to confirm an Apple Pay payment with Touch ID, Face ID or pressing the side button twice, a contactless transaction cannot be secretly started on your device by a mobile payment device. This risk is present with an ordinary bank card (for smaller amounts). With the Apple Watch, continuous skin contact is required to pay. And if your iPhone is stolen, you can go through Find my iPhone on icloud.com, you can also block all your Apple Pay payments.

Privacy

Another strong point of Apple Pay is privacy. Apple Pay is designed for personal information security. To better recognize a card, Apple stores only the last four digits of your account number and associates them with your Apple ID, making it easier to add them across all your Apple devices.

TipWith the Pass4Wallet app you can also add all kinds of non-payment cards such as bonus cards to your iPhone Wallet, so that you can leave them at home in the future. Those cards will not be visible on your other Apple devices. |

Retailers do not receive your name, account number or security code with Apple Pay, but only a replacement token making credit card payments in particular much more secure. Because you no longer have to enter your credit card details online, this reduces the risk of fraud. Furthermore, Apple does not register what is purchased and they do not store the transaction data per user. The Wallet app does show your latest transactions, but that data is not available in iCloud and is therefore not visible on your other Apple devices. You can only view all transactions in your banking app.

|

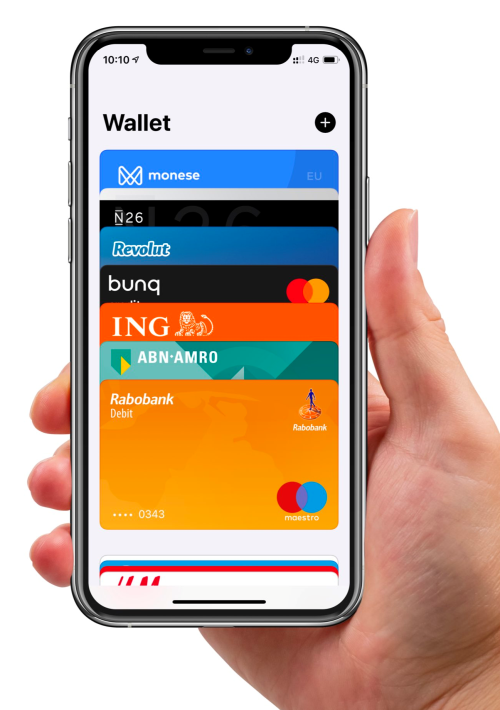

| In the wallet app you can fit via the plus sign add multiple banks (photo via Twitter: @ApplePayNLD)

|

Additional options

In addition to the bank account or credit card that you have linked to Apple Pay, you can also increasingly store all kinds of tickets in Apple’s Wallet app. You can think of travel tickets, entrance tickets and discount coupons. Your real wallet is becoming increasingly redundant as a result. You just have to make sure that your iPhone doesn’t run out of power if you don’t use an Apple Watch. If you can’t keep a ticket in the wallet, you can always drag it to the notes app, after which you can retrieve it on all your Apple devices.

From the Wallet app you can add a maximum of twelve payment cards or credit cards via the plus sign in the top right corner to pay with Apple Pay from now on. On older iPhones and on the MacBook, you can add up to eight cards. You can indicate per card which card you want to pay with as standard, so that you do not always have to choose a card for contactless payments.

|

|

In 2023, log in and out everywhere with Apple Pay at public transport gates with the OVpay logo |

OVpay soon also with Apple Pay

In many other countries, you can use Apple Pay to travel on public transport. Tests are already being carried out on a small scale in the Netherlands to log in and out with your debit card or credit card instead of the public transport chip card. The 60,000 check-in and check-out points will be adjusted and perhaps people can stop using the OV chip card in 2023. At the city buses of Arriva in Delft, Zwolle, Zaanstreek, Groningen, Gooi- en Vechtstreek, Voorne-Putten and Rozenburg, Lelystad and Haaglanden and a few other regions, you can already check in and out at the gates with your iPhone or Apple Watch this year with the OVpay logo. The amount with description NLOV will be debited the next day.

Via https://reisoverzicht.ovpay.nl/ you can request a specified travel overview with the debited amount and the 14 numbers and letters in the description behind NLOV. At the moment, you still need verification with Face or Touch ID when scanning in and out with your iPhone. In the long term, it is expected that via express ov you can use public transport with your iPhone without this verification. Express public transport is then probably only possible with a credit card and a number of special debit cards. The Maestro debit cards now common in the Netherlands cannot be used for this.

Billion dollar fine for shielding NFC chip?According to the European Commission, Apple abuses its market power by not allowing their NFC chips to work together with payment apps from other companies. Under the new Digital Markets Act, Apple faces a fine of up to 10 percent of its global revenue and may even require a company to be split up. With such a sword of Damocles hanging over its head, it is not surprising that Apple has said in a response that it wants to continue working with Brussels to ensure that European consumers have access to the payment options of their choice in a secure environment. |